Basics of Construction Accounting - Live Event

$564.00

General Member Price: $368.00

Purchasing on behalf of another customer?

If you are interested in purchasing a product on someone's behalf or need to place a bulk order, please contact CFMA Education at education@cfma.org or call 609-452-8000, press 3 for Education.

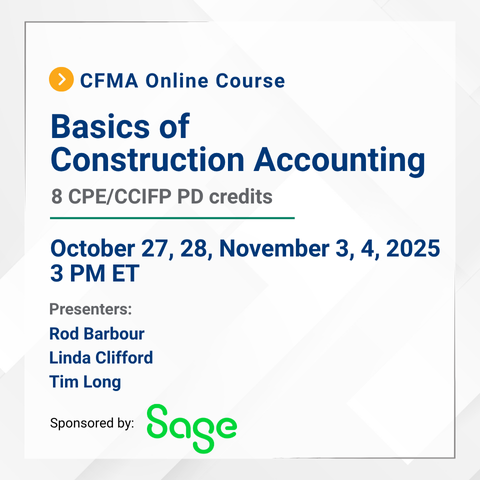

Monday, Tuesday, October 27 & October 28, 2025, 3-5 pm (ET), 12-2 pm (PT)

Monday, Tuesday, November 3 & November 4, 2025, 3-5 pm (ET), 12-2 pm (PT)

This course is designed for accounting professionals new to the construction industry, as well as construction industry professionals who want or need a better understanding of construction accounting processes, construction cost management systems, job costs and job cost reporting, work-in-progress (WIP), and the most important elements of a contractor's financial statements. This course introduces the key processes and practices that make construction accounting unique.

Monday, Tuesday, November 3 & November 4, 2025, 3-5 pm (ET), 12-2 pm (PT)

This course is designed for accounting professionals new to the construction industry, as well as construction industry professionals who want or need a better understanding of construction accounting processes, construction cost management systems, job costs and job cost reporting, work-in-progress (WIP), and the most important elements of a contractor's financial statements. This course introduces the key processes and practices that make construction accounting unique.

Learning Objectives

After this session, you will be able to:

Prerequisites

This is a group-internet course at the Basic Level. No prerequisites or advanced preparation required.

CPE Credits

8 CPE credits

CPE/CCIFP Information

Earn 8.0 CPE/CCIFP Professional Development credits toward the General or Construction Requirement.

Course Length

The estimated time to complete the course is approximately 480 minutes, depending on the pace of the learner.

Who Should Attend:

Field of Study:

Accounting

Speaker:

Linda Clifford